Leizl M. Tabon, CPA

The New Year is upon us and that means another tax season is just around the corner. As you may know, Congress passed the Tax Cuts and Jobs Act of 2017 (TCJA) on December 22, 2017, which took effect on January 1, 2018 and will impact your upcoming tax filing in 2019. While much of the voluminous tax bill is an attempt to clean up the current tax code after all of the bills previously enacted, there are some major provisions impacting individual and small business taxpayers. Here is a recap of the major provisions that could affect Maui residents.

Individual Provisions

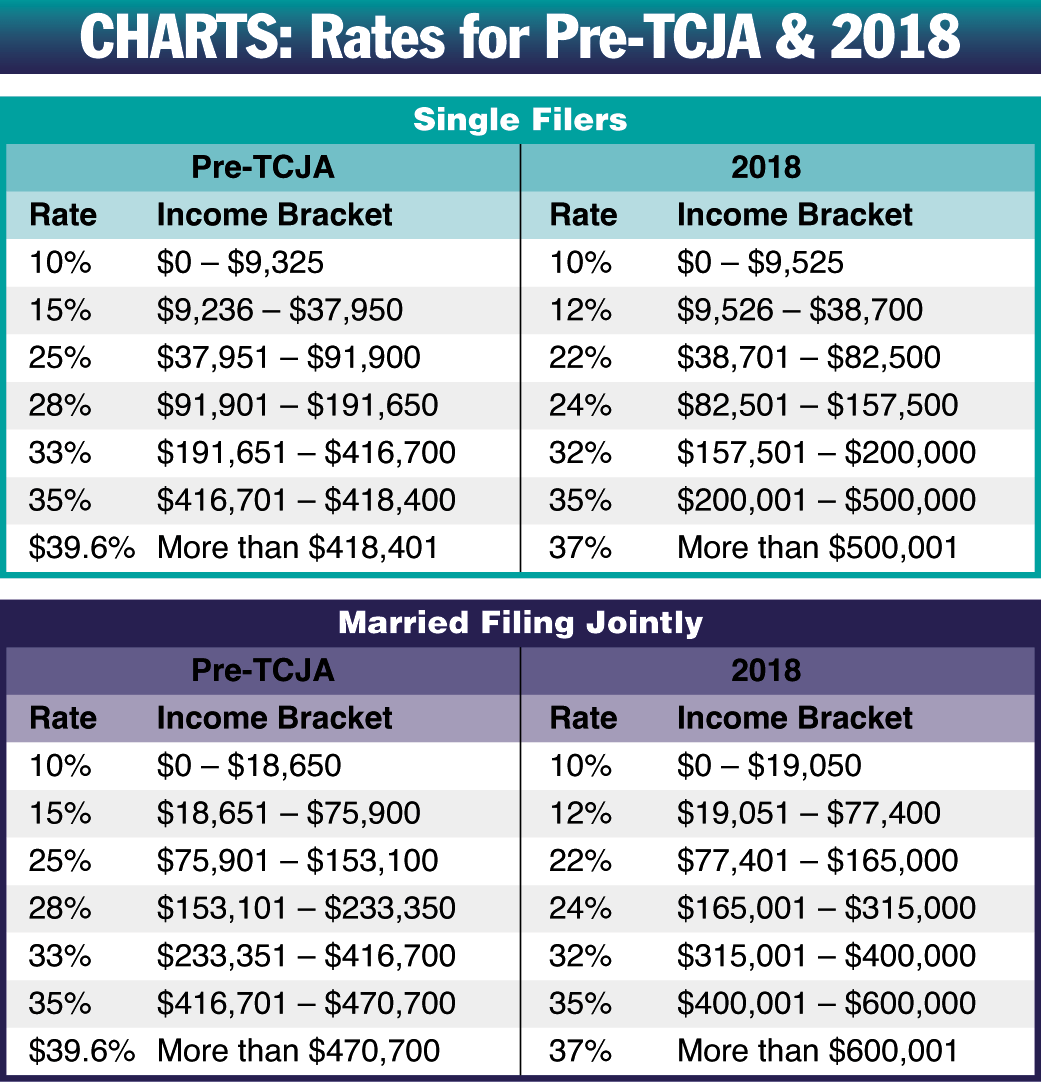

Tax Rate Changes

Under the TCJA, changes were made to the tax rates and the income levels where each of the brackets begin. The new rates and brackets compared to the pre-TCJA amounts are summarized as follows: (See Charts, [ direction ] ) No changes were made to the capital gains rates, which are still 0%, 15%, and 20%; however, the thresholds have been adjusted. The 0% rate will apply to capital gains up to $38,600 for single and $77,200 for married filing jointly. The 15% rate will now apply to capital gains up to $425,800 for single and $479,000 for married filing jointly.

Despite talks of Obamacare repeal, the 0.9% additional Medicare tax and 3.8% net investment income tax enacted as part of the Affordable Care Act, remain unchanged. Additionally, the health care individual responsibility payment (more commonly known as the penalty for not having health insurance) was repealed effective January 1, 2019. If you were uninsured during 2018, you could be looking at a penalty of up to $2,085.

Changes to Itemized and Standard Deductions

In order to pay for the tax cuts, Congress had to find other ways of raising revenue. The TCJA seeks to make up the revenue by limiting or eliminating deductions. Probably the most contentious of these provisions is the limitation of state and local taxes (SALT) deduction. Prior to the TCJA, there was no limitation on the amount of state income and property taxes deducted. Now the cumulative total of all state income and property taxes paid is limited to $10,000 a year. Another limitation imposed is the mortgage interest deduction. Previously, you were able to deduct mortgage interest paid on up to $1 million in acquisition debt and $100,000 of home equity indebtedness. Under the TCJA, mortgage interest is only deductible on new mortgages (entered into after December 15, 2017) of up to $750,000 of acquisition debt.

The TCJA also repealed miscellaneous itemized deductions. This category includes deductions for unreimbursed employee expenses, investment expenses, tax preparation fees, and safe deposit box fees.

Along with the changes made to itemized deductions, the standard deduction for each filing status has been nearly doubled ($12,000 for single filers and $24,000 for married filing jointly). As a result of these changes, it is estimated that a significant number of taxpayers that previously itemized, will now be claiming the standard deduction for 2018.

In addition to the reductions and limitations of itemized deductions, the TCJA has also eliminated personal exemptions. This amounted to $4,050 per person claimed on the tax return.

Tax Credits

In order to reduce the impact of the personal exemption repeal, which mainly affected families, the child tax credit was increased from $1,000 to $2,000. The current tax credit is refundable up to $1,400 and the income threshold for claiming the credit has been increased to $200,000 for single filers and $400,000 for married filing jointly, thereby ensuring that more taxpayers are able to claim the full credit amount.

In addition to the child tax credit, Congress introduced the credit for other dependents, which allows for a $500 nonrefundable credit for each qualifying person. A qualifying person would be any dependent that does not meet the definition of a qualifying child (e.g. a dependent parent).

All of the individual provisions of the TCJA are temporary and are set to expire on December 31, 2025. Absent any legislation extending the various tax provisions, everything with respect to individuals will revert back to pre-TCJA on January 1, 2026.

Business Provisions

Corporate Tax Rate

The simplest change enacted by the TCJA is the change to the corporate tax rate. The previous tax structure was a progressive tax structure (like the individual tax rates) with the maximum rate of 35%. The current tax rate is a flat 21%. Unlike the individual tax provisions, this change is permanent.

Section 199A Passthrough Deduction

Most small business are not C corporations; rather they are either a sole proprietorship or some type of passthrough entity such as an S corporation or LLC. In order to balance out the tax cut for C corporations, the TCJA added Section 199A Qualified Business Income Deduction to the tax code.

While the C corporation tax reduction was the model of simplicity, Section 199A is anything but. The complexities of this law are numerous and has been the subject of discussion since the bill first came out. Additionally, the IRS has not yet finalized its guidance on this law, leaving many aspects of this code section up to interpretation.

In its simplest iteration, the Section 199A deduction (also known as the passthrough deduction) allows for a 20% deduction on qualified business income from a sole proprietorship, S corporation, LLC, or partnership. The actual deduction taken is subject to numerous limitations such as type of business, taxpayer’s taxable income, wages paid from the business, and the cost of assets owned by the business. Because of all of these limitations and factors, the calculation of this deduction will vary greatly from business to business. As such, it is important for small business owners to consult with their tax professionals to see how this deduction impacts them.

Other Business Provisions

Other changes enacted by the TCJA that business owners should be aware of are as follows:

• Entertainment expenses repealed: expenses related to entertaining clients are disallowed. This includes sporting events, concerts, and other amusement or recreation activities. It also includes dues and fees paid to any club organized for recreation or social purposes. Meals with clients or employees/coworkers are still 50% deductible if business was discussed during the meal.

• Net operating losses: any business net operating loss (NOL) generated after December 31, 2017 will no longer be allowed to be carried back to previous tax years. Rather, the NOL will be carried forward indefinitely and the deduction will be limited to 80% of taxable income.

• Excess business losses: the amount of business losses that exceed total gross income plus $250,000 ($500,000 for joint returns), will be disallowed and treated as a net operating loss and will be available for carryover under the NOL rules.

• Section 179 deduction made permanent: businesses are able to fully deduct the cost of eligible property purchased during the tax year. The maximum deduction allowed is $1,000,000 on total purchases of $2.5 million. For years after 2018, these limits will be adjusted for inflation.

• Bonus depreciation enhanced: for eligible property placed in service after September 27, 2017 and before January 1, 2023, businesses are able to take 100% bonus depreciation on new and used assets (the previous law only allowed for the deduction on new assets), thereby fully deducting the cost of the asset in the first year. The allowable deduction is reduced by 20% each year after 2022, with a full repeal after 2026.

For further clarification on what constitutes eligible property for Section 179 and bonus depreciation purposes, please consult with your tax professional.

This is a very brief outline of some of the Tax Cuts and Jobs Act provisions and is not meant to be construed as tax advice. Many of these provisions have other limitations and rules that could apply to your particular tax situation so it is very important that you meet with your tax professional to discuss specifically how these tax law changes impacts you.