The 2021 State Legislature Ends

Success or disappointment? Maui’s legislative team comments.

Alfredo G. Evangelista | Assistant Editor

“This session was a little disappointing for me,” asserts Representative Tina Wildberger (D-Kīhei, Wailea, Mākena). The Vice Chair of the House Government Reform Committee (“Gov. Reform”) feels the House missed several opportunities to re imagine our economy. “We failed to make critical changes to the status quo in the wake of the pandemic to create a silver lining in this dark cloud of hardship that COVID-19 presented,” she concludes.

Still, Wildberger and other members of Maui’s Legislative delegation found some reasons to celebrate in stabilizing the state budget outlook.

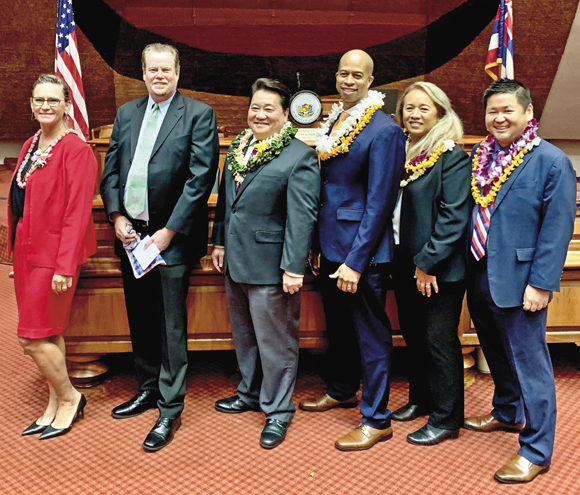

Photo courtesy Gil Keith-Agaran

“Our main job as legislators is to approve a balanced State Budget,” explained Senator Gilbert S.C. Keith-Agaran (D-Wailuku, Waihe‘e, Kahului), Vice Chairman of the Senate Ways & Means (“WAM”) committee. With the assistance of the American Rescue Plan Act (“ARPA”) federal funds, he claims the Legislature successfully passed a budget that filled in the huge local financial hole caused by the pandemic-related economic meltdown. Keith-Agaran’s fellow Senator, Rosalyn Baker (D-South and West Maui), Chairperson of the Senate Commerce and Consumer Affairs committee agreed: “Clearly the most important bill that the Legislature passed this year is HB200, CD1 which is the State Budget bill.” Going into the session, the Legislature faced, depending on projections, a shortfall anywhere from $1.6 billion to $3 billion in general tax revenues.

“Working with our federal partners and the new Biden administration, we were able to pull down millions of federal dollars to replace state funds for critical services programs and positions in Maui,” stated State Representative Angus McKelvey (D-West Maui, Mā‘alaea, North Kīhei), Gov. Reform chair. Without the bailout from the federal government, Mc-Kelvey, Wildberger and their fellow Representatives concede there would be major job losses and department cuts. Under the budget bill passed, the departments received approximately a 10 percent reduction in their budgets. The federal monies came with strings, including limiting the ability of the State and Counties from providing new tax relief and requiring general tax support of lower and higher education remain in the same proportion of spending as in pre-pandemic budgets. The “strings” dissuaded the Legislature from some proposals, Keith-Agaran noted, “We also couldn’t address providing tax relief for working people who collected unemployment benefits as a result of the pandemic shutdown and for businesses who had their pandemic loans forgiven.”

“With the help of our Congressional delegation, the most significant accomplishment was being able to prevent the furloughs and layoffs that were originally proposed for state workers, including teachers,” observed Representative Justin Woodson (D-Kahului, Pu‘unene;, Old Sand Hills, Maui Lani), House Education committee chair. “This was extremely important because the furloughs and layoffs would have negatively impacted our children throughout the state.” Woodson called the lack of financial certainty at the beginning of and during the session “the greatest challenge.”

State Representative Troy Hashimoto (D-Wailuku), Vice Chair of the House Housing Committee, concurred: “Passing a balanced budget without any public employee furloughs or major reductions to important public services, while also assisting the business community impacted by COVID-19.”

Baker noted HB 200, CD1 “contains both the operating budget for the many State departments of the Executive Branch but also provides funding for important capital improvement projects (CIP) throughout Hawai‘i.” Baker gave high marks to Keith-Agaran, who was responsible for the Senate’s CIP budget while State Representative Kyle Yamashita (D-Spreckelsville, Pukalani, Makawao, Kula, Keokea, ‘Ulupalakua, Kahului) led House CIP negotiations. “Mahalo nui loa to Sen. Gil Keith-Agaran, the Vice-Chair of the Committee on Ways and Means, for doing such a terrific job in crafting the CIP budget and to Senator J. Kalani English, a WAM member, and our Majority Leader who always looks out for the best interests of our islands and unfortunately resigned his Senate seat due to the lingering impacts of his bout with COVID-19.”

Keith-Agaran explained the public works spending included “$296 million for Maui projects (not including projects embedded within various lump sum appropriations).”

The Maui delegation identified various CIP projects on Maui that received funding:

• Baldwin High School (electrical upgrades)

• New Central Maui Elementary-Middle School (design)

• New Central Maui Wastewater Treatment Plant (funds to match County)

• Ha‘iku; Elementary (various repair and renovations)

• Hana Bridges (continuing bridge preservation implementation)

• Hana Highway (improvements and rockfall mitigation Huelo-Hana)

• Hana High and Elementary (renovation of culinary arts facilities)

• Hoapili Hale (security improvements; parking structure renovations)

• Kahului Harbor (modernization implementation)

• Keokea-Waiohuli Hawaiian Home Lands (Phase 2B & 3)

• King Kekaulike (black box theater)

• Lahainaluna High School (teacher housing)

• Lahaina Intermediate (play court improvements)

• Makawao Public Library (expansion)

• Maui Community Correctional Center (expanded housing)

• Maui High School (field house design)

• Maui Health Systems (additional ICU beds, COVID care units and COVID ICU; lump sum for various renovations, repair and maintenance at Maui Memorial Medical Center, Kula Hospital and Lāna‘i Community Health Center)

• Maui Produce Processing Cooperative (Kula vacuum cooling facility repairs)

• Maui Waena Intermediate School (whole school renovations)

• Molokai High School (gym renovation)

• Molokai Veterans Center (repair and renovations)

• Nä Wai ‘Ehä Watershed Watershed (acquisition)

• Pälä‘au State Park (renovations and maintenance)

• Upcountry Maui (deer fencing)

• Wai‘änapanapa State Park (construction of planned improvements)

• Waihe‘e Elementary (covered outdoor learning space)

• Wailuku Elementary (parking lot improvements; electrical upgrades; campus-wide air-conditioning project)

All politics being local, West Maui Rep. McKelvey highlighted HB 1311 HD2 SD2 CD1. “This measure not only secured $37 million for the construction of much-needed affordable rental units in Lahaina but also provided a pathway to ensure the proper steps were taken for archaeological reviews of affected sites as well as saving the Front Street apartments once and for all.”

Education lead Woodson noted the importance of passing HB613 which provided funding to air condition all remaining public school classrooms, among other allocations of federal funding for the public school system. “It also offers teachers a one-time $2,200 bonus and provides funding to address school issues related to the pandemic,” added Woodson.

Keith-Agaran observed how “the entire delegation helped push through honoring Mayor Elmer F. Cravalho by renaming the Kahului Airport Access Road after him. Mayor Cravalho, a great friend of the Filipino community, was a towering and impactful figure in building the Maui we know today.”

Other bills highlighted as important by Maui’s delegation include:

• SB 512 – expanding SNAP DoubleBux benefits for more locally grown fresh food;

• SB 973, SD1, HS2 CD1 – amending the Money Transmitters Act;

• HB 817 – requiring a minimum of 10 percent of produce purchased by state departments be grown locally by 2025;

• HB 1023 HD1 SD1 CD1 – creating a nonresident fishing license program, increasing funding for enforcement and ensuring free and unmitigated access for cultural gathering rights;

• HB1176 – allocating $5 million for up to 1,000 participants in a Green Job Youth Corps program;

• HB 1192 HD1 SD2 CD1 – transitions from lump sum deferred deposit transactions to installment loan transactions; specifies various consumer protection requirements for installment loans (payday lending);

• HB1376 – helping tenants renegotiate and mediate terms of their leasing agreements so they are able to stay in their rentals;

The first bill signed by Governor David Ige (becoming Act 1) kept unemployment trust fund payments by employers at a more reasonable level than the current law would have otherwise required. Wildberger described it as “a remarkable demonstration of cooperation” between the House and the Senate. She said Act 1 prevents unemployment contribution rates from “skyrocketing and crippling small business employers.”

Photo courtesy Troy Hashimoto

Hashimoto agreed, “An additional assessment would have been detrimental to businesses at a time when they are trying to recover and bring more employees back to work.”

McKelvey noted the difficulty, however, in providing more relief. “We were able to fast track a bill to hold the Unemployment Insurance (“UI”) schedule rating at its present level instead of allowing it to escalate as it would’ve done in March. While we would’ve liked to roll the UI schedule back, the federal government requires us to show a good faith effort and replenishing our UI funds. As such, a move could trigger the loss of major federal support down the road.”

“I was hoping we could provide some additional direct relief to Hawai‘i workers,” said Keith-Agaran. “The Senate did pass a modest minimum wage hike but could not move the bill forward … ”

Wildberger agreed with Keith-Agaran that the House’s failure to act on the minimum wage bill was a disappointment. “The House failed to raise the minimum wage, again even though the Senate managed to send over a $12/hour wage increase. There were several different bills put forward to raise the minimum wage this year but my bill HB1201, Essential Wages for Essential Workers, would have paid $15/hour to workers. And small businesses would have benefitted from a robust tip credit.”

Wildberger also noted the Legislature failed to pass any substantial criminal justice reform legislation such as the no-knock warrants and police accountability.

Photo courtesy Gil Keith-Agaran

The Legislature also failed to legalize “responsible, adult-use cannabis which would have increased desperately-needed tax revenue, diversified our economy with high-paying Ag Jobs, and reduced costs and addressed over population at our jail simultaneously,” she said.

Wildberger observed many bills were introduced to tackle the state’s shortcomings “but most of them sadly stalled in committee.”

Hashimoto observed the Legislature “did not have any big policy shifts that were moved this past session—such as taxation reform, legalization of cannabis or gambling, minimum wage, or large reforms in government operations.” Hashimoto specifically identified the inability to find solutions for new funding sources for both the Department of Hawaiian Home Lands (DHHL) and the Office of Hawaiian Affairs and the lack of funding to create a John A. Burns School of Medicine cohort at Maui College as major disappointments. Keith-Agaran noted, however, that CIP funding for DHHL infrastructure will be noticeably more than in recent years, including specific allocations for Këökea-Waiohuli and Pülehunui on Maui and for the Molokai water system. A DHHL proposal for licensing a casino also received no hearing in one of the two chambers.

Keith-Agaran also noted that “While the Mayor and Council’s request to add a Maui County surcharge to the general excise tax did not pass, the County may have the opportunity to pass its own hotel room tax under HB862. The County will not have to lobby the legislature every year for a share of the state hotel room tax and will have more control over the use of revenues from the visitor industry for Maui Nui needs.” Hashimoto said “Tourism management has been a buzz word and is a priority of the Legislature through reforms at the Hawai‘i Tourism Authority and also allowing the counties to enact their own transient accommodations tax surcharge up to 3 percent to allow for better tourism management.”

Photo courtesy Troy Hashimoto

But McKelvey argues HB 862 was a major disappointment. “While this bill would have created an equitable reallocation of the Transient Accommodations Tax (“TAT”), given the Governor’s action of sweeping these funds into the state coffers by executive order and strengthening oversight over the Hawai‘i Tourism Authority (“HTA”) by using federal funds, down the road when we recover from COVID this will be extremely detrimental to Maui because this act is in perpetuity. By allowing the counties to add on a surcharge instead of being given a portion of the TAT to help offset the impact, Maui will be put at a disadvantage to O‘ahu which has other sources of economic industry besides tourism if they choose not to adopt the surcharge, as well other neighbor island counties could now be pitted against each other. The issue of forum shopping insofar as running the room revenue through corporate offices in a county like O‘ahu, which has not adopted the surcharge. Furthermore, the service charge means that Maui will only get $8 million if visitors numbers reach the levels in 2019 instead of the $23 million that was pre-allocated under the cap, which was also problematic insofar as it was only a percentage of the $200 million and TAT revenue that Maui produces annually. I am confident though that the Legislature will revisit these issues next session and come up with a more equitable plan for revenue sharing.”

Photo courtesy Troy Hashimoto

Wildberger tends to agree with her fellow House member: “HB862 was both a success and a disappointment. It [reins] in the Hawai‘i Tourism Authority budget in an attempt to better manage spending on tourism marketing but it also slashes the amount of Transient Accommodations Tax that Maui County receives by two thirds from $22 million to $8.5 million and only if the County decides to surcharge 3 percent on top of the 10.25 percent the State already takes and will now keep.”

“Replacing tourism is not something that will happen overnight,” McKelvey opined “and despite some good efforts because of the severe deficit crisis caused by COVID the Legislature wasn’t able to do much to try to be more aggressive with diversification as soon as possible. That being said, measures to help expand and increase the multiplier effect of visitors in businesses that are not directly associated with the visitor industry but they provide a large stream of commerce to them was expanded through several measures and by increase in support of value added products, which is the largest sector of these types of businesses.”

“An increase to the $5 car rental surcharge was also passed—$0.50 per year until 2027—to help fund projects such as the Lahaina Bypass, Pu‘unene Avenue Expansion, and the Pa‘ia Bypass,” Hashimoto commented. McKelvey agreed with Hashimoto “These monies will allow us to finally get both the Lahaina bypass extension to Ka‘anapali rolling as well as other needed infrastructure for transportation improvements to offset the impact that the visitors will have, ensuring the quality of life for our residence and a better experience for visitors.” According to Keith-Agaran, the increase “will result in our visitors sharing more directly in the costs for repair, maintenance and construction of our highway system.”

Photo courtesy Troy Hashimoto

McKelvey believes federal funds will help to diversify Hawai‘i’s economy. “I am confident that with the large infusion of federal monies for broadband expansion as well as some of the essential capital improvement projects we can continue to bolster technology businesses and other businesses that do not require people to leave Hawai‘i in order to create and expand on huge market opportunities in the mainland and across the globe.”

Despite the disappointments, some legislators noted a renewed team effort in legislating. “I think the measures that will have the most profound impact on people and will serve the greatest goods were measures that were introduced by multitude of lawmakers,” said McKelvey. “These measures not only reflect the diversity of Maui legislators and their colleagues in trying to tackle these issues but also represents the team first approach in helping to evolve these pieces of legislation addressing concerns or shortcomings and producing superior laws that will hopefully be enacted by the Governor.”

So, it’s now up to the Governor, explains Keith-Agaran. “The Governor will now have a month or so to review the bills sent to his desk, including reorganizing the Office of Planning, reforming the Hawai‘i Tourism Authority and providing the Counties with taxing authority in addition to property taxes, and pushing his agencies towards using more fuel-efficient vehicles, including electric cars, in state fleets. He also will be reviewing bills allocating funds for personal protective equipment and other resources to state agencies and our hospitals for continuing the health care response to the pandemic.”

In the meantime, Wildberger is encouraging everyone to vaccinate: “I want to encourage everyone to get their COVID-19 vaccine. It is safe and we won’t be able to get past this crisis unless everyone gets the vaccine. So do it for your kids so we can get back to school and back to work!”

Next year is an election year and all of Maui’s legislative seats will be up for election due to reapportionment. In 2022, the voters will decide which legislators will, in 2023, get back to work at the Legislature.

Alfredo G. Evangelista is a graduate of Maui High School (1976), the University of Southern California (B.A. Political Science cum laude 1980), and the University of California at Los Angeles School of Law (1983). He is a sole practitioner at Law Offices of Alfredo Evangelista, A Limited Liability Law Company, concentrating in estate planning, business start-up and consultation, nonprofit corporations and litigation. He has been practicing law for 37 years (since 1983) and returned home in 2010 to be with his family and to marry his high school sweetheart, the former Basilia Tumacder Idica.

Alfredo G. Evangelista is a graduate of Maui High School (1976), the University of Southern California (B.A. Political Science cum laude 1980), and the University of California at Los Angeles School of Law (1983). He is a sole practitioner at Law Offices of Alfredo Evangelista, A Limited Liability Law Company, concentrating in estate planning, business start-up and consultation, nonprofit corporations and litigation. He has been practicing law for 37 years (since 1983) and returned home in 2010 to be with his family and to marry his high school sweetheart, the former Basilia Tumacder Idica.